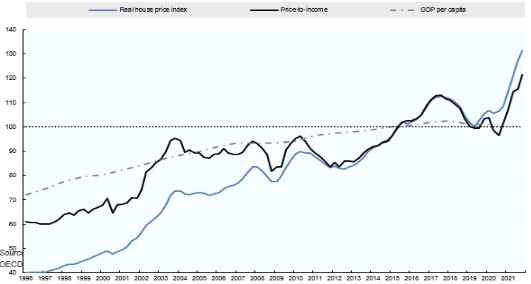

Life in Australia, a centrist Westminster style democracy, and a mixed economy of both planned and free markets has always been a balance between private wealth and the public good. Today, however, we are seeing the uneven fruits of imbalance in the housing sector in particular. Ever since John Howard brought in the capital gains tax discount some 30 odd years ago – inflation in the residential property market has run riot. It has now reached an apogee of unaffordability for many Australians, most of them younger and losing the aspirational dream of home ownership in their lifetimes. Private wealth vs the public good – tough conversations need to be had to address the severe problems around this matter.

Private Interests Pushed By Coalition In Australia

The LNP Coalition has steered Australia toward the neoliberal extremes of the free market economy, as exemplified by the United States, whenever it has been able to get its legislation through. The popularity of this ‘hands off’ approach by governments of both persuasions over the last few decades has left us and other countries like us with real problems regarding housing our population. The market has not taken care of things because we have severe unaffordability issues for both renters and prospective home buyers. There is a shortage of housing stock across the board and housing has become much more expensive to build in addition to the massively inflated property prices.

Neoliberal Economic Failures Produce Uneven Outcomes

Markets do not, as neoliberal economists have promised, provide the best outcomes for all stake holders in the housing process. Human beings require shelter as one of the primary requirements of life. This surely must gazump the interests of those wishing to profit from the financialization of housing in Australia. If a nation cannot adequately house its citizens then something is not right with the economic model and that of government. If one third of the nation’s population are benefitting well from the current housing equation but the other two thirds are suffering – that is not a fair or good outcome for that country as a whole. In Australia, we seem to be slipping back toward the bad old days of gross inequality between the propertied class and the rest. People will not put up with this for long, even apathetic Aussies. Generational change is occurring and if governments don’t make the hard decisions soon things will get ugly. Social unrest is beginning to happen at the edges of society already. Crime will rise and those disenfranchised from the wealth of the nation will take matters into their own hands – history shows us this to be true.

Remember The Commonwealth!

Private wealth vs the public good. The commonwealth! There are certain parts of our lives which should not be run on a ‘for profit’ basis. The basic needs of life should not be at the whim of markets and speculators. Housing/shelter is an obvious example of this. Health is another. In the United States we are seeing private equity corporations taking over hospitals and medical centres to the detriment of the healthcare provided. These large companies are driven by rates of profitability and they strip out the value of the institutions they purchase and leave them as second rate husks in numerous examples seen so far. Private equity borrows heavily to purchase these large hospitals and institutions and then saddles those entities with that debt. The US is a good example of what not to do and not to follow, when it comes to how they manage the health of their citizens. There is very little universal public health insurance in America. More Americans declare bankruptcy from not being able to meet their medical bills than for any other reason. What kind of nation allows that to go on! A country in the grip of Republican extremists who have controlled Congress for most of the last few decades. Congress makes the laws in the US not the President. The privatisation of Australian hospitals by private equity firms has begun via the encouragement of LNP governments.

Tony Abbott The Worst Of The Neoliberals

Thankfully Tony Abbott has been voted out in Australia, as he was the most ardent supporter of Americanising Australia. Abbott tried to turn our higher education into a little America, with our sandstone universities charging ivy league college rates for degrees. This would entrench university being the exclusive privilege of the very wealthy in Australia. The Coalition would love to dismantle Medicare if they could. ‘User pays’ is their neoliberal credo. The stage 3 tax cuts were all about flattening our progressive tax system to favour the wealthy over the working majority. The trickledown effect is their favourite idea – that you look after the wealthy and then everybody else will get just a trickle. In actual fact, studies have shown this not to be the case and only those at the top become much richer and the rest get stuff all. Ten years of Abbott, Turnbull, and Morrison saw the greatest increase to the wealth divide ever seen in Australia.

“Inequality has been on steroids in Australia over the last decade with new data revealing the bottom 90% of Australians receive just 7% of economic growth per person since 2009, while the top 10% of income earners reap 93% of the benefits. The data shows a radical reversal on the long term trend from the period between 1950-2009 in Australia. Australia is a now global outlier in the maldistribution of gains from economic growth, falling behind the EU, US, UK, China and Canada.”

Aussie Cost Of Living Crisis Deepened By Corporate Greed

The very real economic crisis facing many Australians at the moment have followed on from a decade of Coalition rule. The public service was gutted and billions siphoned off to the private sector by Morrison, Turnbull, and Abbott. Robodebt wrongly accused half a million ordinary Australians of owing large amounts of money to Centrelink. Vulnerable people killed themselves over this. It cost taxpayers $1.8 billion in a settled class action against the government. PwC was involved in Robodebt, doing reviews for the Coalition into how much money they could extract from poor Australians. Robodebt was an ideological attack on the welfare state and did lasting damage to thousands of innocent people. No investment in social housing and no foresight into what was happening in the housing market was apparent during their lengthy term in office. Most importantly, was the absence of doing anything about the concentration within markets and disappearing competition. Mergers and takeovers were greenlighted and the ACCC remained an underfunded toothless tiger. Big business got its way under the Coalition. Qantas under Alan Joyce did dreadful things to its workforce for many years. Australia has bugger all competitive sectors and consumers are getting shafted everywhere. Price gouging came about because these duopolies can set the price without fear of competition. Coles and Woolworths controlling the grocery and liquor markets at 65% and 70% levels respectively. Banks reduced to the Big 4 following multiple mergers and takeovers. Media in Australia today is Murdoch, Nine Fairfax, and Kerry Stokes. This means all the news you get in print, on radio and TV tells you what they want you to see and hear. What they will tell you is that Australia is a modestly populated country and is best served by these few big players running the show. Corporate Australia is best served – not the people. Free market economies only function properly if there is real competition in the markets. The RBA uses monetary policy to manage the economy – by raising interest rates on the cash rate to combat high inflation. They will not endorse price controls despite the fact that companies have been increasing their prices beyond increased costs and then some. Ordinary Australians are being crushed by increased costs of living everywhere they do business and purchase essentials. Corporate greed has cost us big time.

“Australians are continuously overcharged and subjected to “profit push” pricing by major corporations enjoying scant competition, resulting in higher inflation and intensifying cost-of-living pressures.

The findings of the ACTU-ordered price gouging inquiry have been published amid renewed scrutiny on the pricing practices of dominant businesses that enjoy a large share of the market, including supermarkets, banks, airlines, and electricity companies.”

Shareholders are held to be of more account than consumers in 21C Australia. Private wealth vs the public good. Governments downunder continue to favour the rights of investors over all others. The absence of competition and the concentration of corporate power is rendering our economy fixed in favour of these large entities. Workers are at a disadvantage in the employment market because of the dearth of employers in sectors. Too much power resides in the hands of too few. This has resulted in decades of slow wage growth. The Coalition has actively gone after Australian union power as well over the last 30 years – this too has increased the imbalance of power within Australia.

Aspirational Politics Is Us Vs Them

Aspirational politics have been sold to Australians on the basis that they individually will become wealthy if they go along with the Coalition and their policies. The public good has been run down, literally and reputationally. Infrastructure has not been reinvested in and replaced on the public level. The push has been all about private this and private that. The funny thing is that most Australians know that when things are done together in a spirit of comradeship it is ultimately more satisfying. Think about when the sporting team you follow wins the premiership it is a wonderfully enriching feeling to share that with your fellow and sister supporters. Philosophically, public good is a far deeper experience than squirrelling away nuts in your own little tree. Private wealth is very much about you vs them. It is a polarising thing in the end.

Private Education Vs Public Schools

Private school education in Australia is another divisive thing and has been growing under the auspices of LNP governments. We have private schools spending tens of millions of dollars on lavish infrastructure and still receiving federal government funding. Meanwhile, we have a public education system still not adequately funded. In America, they have highly segregated schools, where race divisions reflect the wealth status of many schools. If you separate your kids at this formative time how will they ever really learn to get along – you are entrenching racism and inequality. If individual concerns always trump those of the community, then social divisions will remain and grow. In Germany, all schools are state schools and they have far better educational outcomes than we do in Australia. Similarly, in the Scandinavian countries they too have higher standards of academic achievement within a one school type system. Parents want the best for their kids, but it would be a better holistic outcome to lift the standard across the board than provide superior educational opportunities for the privileged few. Elitist private schools produce entitled insular young Australians. Billionaires endowering these Cranbrook’s, Kings School, and Scotch College’s is self-aggrandisement with serious consequences for future generations of Australians.

Green Ideas To Address Housing Crisis

“Speaking to the ABC ahead of his address, Mr Chandler-Mather blamed private property developers for the housing crisis.

“We don’t need more high-end apartments that property developers sell but no-one can afford except for an investor,” he said.

“What we need are homes that people can actually afford, and the way to do that is for the government to build homes where you cut out the profit margin.”

But the Greens’ own policy costing, prepared by the independent Parliamentary Budget Office (PBO), cast doubt over the policy, warning it was “highly uncertain” whether it could be implemented as the Greens intended.

And key elements of the policy remain unclear, including how participating homebuyers would be chosen, and how rents would be set.”

It is easy for those stuck in the tried and true 2 party political paradigm – another duopoly – to throw off at the Greens for making impractical suggestions. However, at least Chandler-Mather is giving it a shot and coming up with stuff outside of the box. Because doing the same old things is not going to fix this problem anytime soon. Governments like not doing actual stuff, and letting the market take care of everything, because they can remain unaccountable and merely a talkfest show. Housing approvals for new constructions have fallen off a cliff and the housing stock increases, we so desperately need, are not being built. If building companies are going broke because of the increased cost of construction materials and the profitability is no longer there for residential constructs, then governments will have to do something different to address the chronic situation. A return to real government involvement is long overdue, in my view.

It is instructive for Australians to take a good hard look at the Unites States of America right now. The dysfunction and polarisation in their politics is rampant and has been for some time. A disgraceful former Australian by the name of Rupert Murdoch has been profiting from this and making everything a whole lot worse via his Fox News network. May you burn in hell Rupert! Of course, hell doesn’t really exist and justice of any kind for wealthy old white men in America is pretty thin on the ground. What kind of Australia do we want to live in? The LNP would like to make Oz much more like the USA. A land of haves and have nots entrenched via race, politics, and who you know. Private wealth vs the public good is always the battle.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord