We are living at a time of rapidly rising costs of living driven by spiking inflation and its consequent interest rate increases. The economy is like a dog chasing its own tail right now. Those many Australians who live on the wrong side of the poverty line are sinking further into dire financial trouble. It is in light of these circumstances that it is important to have an understanding of the Wellbeing Budget.

Conservatives have derided the concept as branded by hippy yippy fringe concerns and un-Budget like. The Budget, in their eyes, should be about cold, hard economic facts with no room for sentiment.

The woman that the hard right despises most, Jacinta Ardern the NZ prime minister, has had a ‘wellbeing’ Budget and that is proof of its unsuitability for them.

By Robert Sudha Hamilton

Wellbeing Concerns Post-Pandemic

The world has changed since the advent of the global Coronavirus pandemic and governments’ response to it. Even conservative governments were forced to increase welfare payments to their citizens and provide economic relief to individuals and businesses through the crises. The media was covering the rampage of the virus through countries, institutions and people’s lives. Health and the caring industries were in sharp focus for nearly two years. Doctors and nurses were lauded by the watching public. Economic handouts were the order of the day and concern for those less fortunate rose exponentially through the pandemic.

All of these things cost the economy a lot of money and the Australian economy has a gross debt of $963 billion as of June 30th, 2022.

(Dossor Rob, Commonwealth Debt, Budget Review 2021-22 Index)

Budgeting in Times of Paucity & Constraint

A new federal Labor government is tasked with providing responsible economic stewardship for the country over the next few years at least. The Treasurer Dr Jim Chalmers is charged with bringing down a Budget for this fiscal year to rein in profligate government spending and to begin to reduce the deficit. The community, however, is still primed with concerns for their own economic plight and for those less fortunate than themselves. A balancing act is required and this is where the wellbeing Budget comes in. Energy prices are predicted to rise a further 35% in the coming financial year. The war in Ukraine is responsible for fanning the flames of inflationary pressures in the energy markets. Australia is one of the largest exporters of LPG in the world, which benefits the international corporations doing business here but not the nation itself, that much, it seems. We are struggling on the east coast to reserve enough gas for our own domestic needs and the prices are going through the roof. Previous state and federal governments have failed to value our resources properly in the deals made with these energy sector companies who dig them up.

Australians are faced with having to beg cap in hand for access to our own sovereign resources because our governments have sold them too cheaply. The short memory span of the general public and the lack of detail about these deals made public saves these politicians again and again.

Ultimately, we only have ourselves to blame for our ignorance and apathetic acceptance of our lot.

What is Wellbeing?

Wellbeing is not about smelly candles, incense, and spa treatments. These may be what the uninformed know about the term ‘wellbeing’ but it is a misnomer. Those things are the commercial exploitation of what wellbeing actually refers to. According to the Oxford English Dictionary, wellbeing is a noun, which refers to, “the state of being comfortable, healthy or happy.” Pretty simple really, isn’t it? A wellbeing Budget, therefore, is all about making us comfortable, healthy and happy. I don’t think that it should be an ‘or’ situation in regard to health and happiness, do you? A Labor government is traditionally concerned with making things more equitable for its citizens. Fairness for all and assisting those that have been left behind in the economic stakes. Economically speaking, if you neglect those on struggle street it will cost the community more down the track in terms of spending on health, law and order, and infrastructure. It costs far more to rectify societal problems than to prevent them from occurring in the first place. Australia is fast becoming a land of ‘haves’ and ‘have nots’ with a seriously inequitable share of wealth. Understanding the wellbeing budget in light of what it really means will be important if we are to embrace it fully.

“Half yearly profits for all companies together had almost doubled to $US55.2 billion ($79.6 billion), up from $US28.7 billion for the same period last year…” (Taylor, August 2022)

“The wealthy, those who can afford to be shareholders, are pocketing lots whilst those struggling are being screwed by rising costs everywhere they turn. Wages, meanwhile, are taking a dive as they fail to keep pace with an inflation rate of 6.1%, as of the June quarter in 2022. Stagnant wage growth in Australia for a couple of decades has meant that Australian workers are falling behind in terms of what their pay packets can provide. Higher inflation is widely tipped by most economists and the RBA for the next quarter and beyond. The consequence of this will mean more people forced to borrow money to meet the cost of living. Credit costs are being raised by the RBA in a bid to dampen demand and stop the inflation spiral.” – (Joseph Trimarchi, September 2022)

“A study found that household wealth in Australia is very unequally divided.

- The highest 10 per cent of households by wealth has an average of $6.1 million or 46 per cent of all wealth.

- The next 30 per cent has an average of $1.7 million or 38 per cent.

- The majority – the lower 60 per cent – has an average of $376,000 or just 17 per cent of all wealth.

Over 130 billionaires in Australia each hold an average of $3600 million in wealth.” – (UNSW Report, July 2022)

Wellbeing will be hard to achieve for many in the current economic climate here in Australia. One of the few things going for some in the community is the historically low unemployment rate. This is again due to the pandemic via closed borders, lock downs, and low rates of immigration into Australia. Businesses, however, are clamouring to raise these rates to get more workers to fill vacancies. A recession may be just around the corner and so expect to see unemployment rates soon rise again. There is a massive shortage of rental accommodation in the capital cities of Australia right now. Rents have gone up on average 35% in Brisbane. Increased rates of migration to Australia will compound this problem even more, as these new arrivals will need somewhere to live.

The right wing narrative around welfare spending goes something like this – “these people don’t deserve economic help because they are lazy bludgers who don’t want to work. I don’t want my taxes being wasted on ungrateful layabouts who should be busting a gut to get a job, any job.”

The idea of tough love, which has informed the consistent government line on welfare spending to produce an Australian dole payment in the bottom half of a graph of comparable OECD countries. We force those unemployed to live well below the poverty line and hope that the discomfort and damage to their health and happiness levels will provoke them into taking any kind of job to escape their current circumstances. Understanding the wellbeing budget may well free us from such backward and draconian thinking going forward.

In America, right now we have a superpower split down the middle between Democrats and Republicans. The Republican party line appeals to those who don’t want to pay taxes to help those who may be from minority demographics traditionally locked out of easy access to the wealth of the nation.

All countries have systemic inequalities and injustices built up over generations, as vested interests look after their own to the detriment of others. The establishment remains powerful because it controls the levers of government and dominates the marketplace too.

Not all white skinned citizens of the USA have benefitted from the dominance of the white, male cohort over several centuries. This is why someone like Donald Trump can come along and appeal to the majority of poorer white Americans. Telling them he will make America great again and this time they will share in the that predicted motza. Of course, this wont happen and they will get shafted by super wealthy Americans like Donald Trump. Trump has already raised some quarter of a billion dollars on the back of his latest campaign to resume the Presidential mantle in 2024. Trump claimed that he was a self-made man but in reality he was the son of a very wealth New York property developer Fred Trump. Trump has lied throughout his life and times to present himself as some Ayn Rand capitalist champion. Trump was gifted around half a billion dollars from his father in cash and assets to establish Trump Enterprises. This was revealed via the New York Times after their 18 month investigation into the Trump family property and tax dealings in 2018.

The truth is that wealthy people here in Australia and America want to hang onto their wealth and not see it reduced via taxes. Many of these people have worked very hard to establish their wealth for family. Thus, they are susceptible to narratives which paint the poor as undeserving.

I know friends of mine who are on most scales well-balanced human beings who spout these right wing fuelled lines about dole bludgers and sections of the community who are actively undermining Australian values via their lifestyle choices. This is rubbish pedalled on talk back radio by shock jocks who are invariably right wing conservatives. There may well be a few individuals who don’t want to work for a living but by far the majority of Australians just want a fair go and equal opportunities. Successful people and their businesses must pay more taxes to help create a fairer Australia for all. Otherwise we will tip over into an undemocratic regime and there will be hell to pay in the long run. History teaches us that great civilisations fall, like the Roman Empire, on the back of extreme inequality provoking civil war and strife.

Australians may be largely apathetic but that is because of the comfort zone here, when that evaporates watch out. When people are hungry and angry violence is the natural reaction to these states.

The pandemic has, hopefully, taught us about looking after all and not just those who look and seem to be like us. Indigenous Australians have suffered severe neglect and racial discrimination for a couple of centuries. In many suburban precincts of Australia you do not see any First Nation’s people – they are largely absent from the streets of white Australia. Their dark skin has seem them pushed to the fringes of our society in ghettoes like Redfern and far flung regional areas.

“Indigenous Australians make up 3.3% of the national population, according to the 2021 Census figures. This estimates the population of Aboriginal and Torres Strait Islanders at 881, 600. 38% of the population live in the major cities, 18% live in remote areas, and the remainder in regional parts of the country. (IWGIA, 2022)

The 2019-2020 median gross weekly income for Indigenous Australians over 18 was $553. The figure for non-Indigenous Australians is more than $1, 000. In 2020, 53% of Indigenous Australians over 16 were receiving some form of government income support. 27% were on Newstart or Jobseeker. 39% reported that their household experienced days with no money for basic living expenses over the previous 12 months. (AIHW, 2021)” – (Trimarchi, 2022)

A cursory look at these figures will confirm that there is a lot of work to do to improve equality for Indigenous Australians. The upcoming constitutional vote on an Indigenous Voice to Parliament will be crucial in changing the cultural bias in Australia away from centuries of ingrained discrimination. There needs to be a groundswell of support and love for all First Nation’s people in this country. White Australia will need to wrap their arms around their Indigenous brothers and sisters and look out for their wellbeing for the foreseeable future. Level playing fields are not established in single lifetimes, rather it can take many generations. Young countries like Australia, often, struggle with commitments on these time scales. Youth has no time for history.

Wellbeing Budgets are about targeting the economic comfort, health and happiness factors of a nation’s constituents. We must always look after those most deserving first. Those that cannot afford to pay the rent, buy enough food for their family, and pay for the energy to power their home and mode of transport.

What governments in Australia have often done is allocate funding to programs and groups without any follow up monitoring. Accountability for spending and its outcomes have been sorely lacking historically at all levels of government. Money spent here or there becomes a line on a budget sheet but what happens next over the years is nowhere to be seen. We need follow up and have rigorous oversight to see what is happening to the millions and billions of dollars being spent. The Medicare rorting expose by the ABC, Age and SMH newspapers highlight the lack of accountability by governments here in Australia. 8 billion dollars is estimated to be rorted and/or wasted via Medicare payments from this tax funded health program every year. Medicare has been a sacred cow for much of its life and is a wonderful thing for all Australians. However, waste and rorting to this sizeable tune is costing the nation enormously and depriving many more needy sections of the health budget from getting adequate funding. Cosmetic surgery is being wrongly funded by Medicare by scumbag medical practitioners intent on rorting the system for their own benefit. Not all doctors and health practitioners are saints it seems. The white coats may be hiding ulterior motives like greed and avaricious materialism rather than any do gooder motives. Of course, many in the health sector worked tirelessly during the pandemic to save lives and risked their own in the process. Cosmetic surgery, especially that performed by inadequately trained practitioners, is not included under Medicare, in most instances, for a reason. It is not considered to be an essential health service in the majority of cases. The hand that life deals you in terms of physical attributes is what we all are blessed or cursed with, any enhancements should be self-funded unless the status que is horrendously damaging to your wellbeing and ability to live a rewarding life. There will always be sliding scales of what is considered thus as we progress as a society going forward.

The federal Labor Albanese government has made a point of identifying multinational corporation tax avoidance as a major economic issue for Australia. They went to the polls with a plan to establish a 15% minimum tax rate for the Microsoft and Googles of this world operating in Australia.(Murphy, April 2022) Currently, these entities shift profits to tax free locales in places like Ireland and elsewhere. Globally you have these tech companies generating enormous profits and paying very little tax anywhere. How does this support making the world a fairer and more equitable place if the money goes to investors and not to government coffers. Right wing narratives pipe up saying that governments waste money and that the trickle down effect will sort things out. Bullshit, just look at the growing inequality in places like America and Australia. Conservative governments deliver for their stakeholders to the exclusion of the poor and dispossessed. The rich get richer and the rest struggle to exist. The stage 3 tax cuts for those earning the most each year in Australia are a pertinent example of what the Morrison government delivered. Creating an unfairer Australia with top tax rates reduced and the tax system flattened to propel the wealthy further up the ladder and weaken any attempts at wealth redistribution in this country. The short memories of wealthy Australians conveniently block out any talk of unfair advantages created by systematic inequality for minority groups like Indigenous Australians, women, LGBTIQ+, the disabled, and new migrants to this country. The right wing narrative tells its proponents that, “Australia is basically a fair place, just don’t look too closely. These people are bloody lucky to live in this great nation and they just need to know their place, which is at the back of the queue. Be quiet and suck it up if you don’t belong to the same bloodlines, clubs, associations, and interests as us.”

The conservative narrative is all about splitting things up and is predicated on the assumption that there isn’t enough to go around. Jobs for the boys. Look after the straight and narrow and challenge anything else. Anything different is no good. Diversity is a sick joke to these folks.

The wellbeing of themselves, their family, and maybe friends is paramount. The white suburban heartland is their Mecca, where houses and lawns look alike. Cosmopolitan city centres are okay for a visit but they wouldn’t want to live there. Social conservatives just trying to get ahead and making sure they stay there.

I was listening to Barrack Obama speaking the other night and he had some interesting observations about America and the great divide between Democrats and Republicans. He said that Democratic politicians just need to keep putting forth their basic premise of equality and fairness for all, even, in the face of the extreme ugliness of Trumpism, which has infected the Republican party.

The lies and distortions put forward by GOP candidates remind me of the mass psychosis and hallucinations during the witch trials in places like Salem. Americans seem vulnerable to this kind of collective madness.

The colonial roots of America, like Australia, is built on the invasion, murder, and dispossession of the indigenous population. The enslavement of Africans captured and imported into the country as slave labour came next. Australia had its own chapter of this with the blackbirding of Pacific Islanders – something not taught at school when I was attending in the 1970s. (Higginbotham, September 2017) These horrendous periods for the victims of such abuse are quickly brushed over in modern Australia’s recollections. The generational damage to the families impacted by such institutional abuse and exploitation is rarely considered by right wing demagogues in the media. Wellbeing is not a band aid, it is not a soak in a sweet smelling spa bath, it is not an unmonitored cash splash (often snaffled up by some white scumbag businessman), no – it takes decades of stringently implemented programs with a commitment to rigorous accountability by governments and their public servants. Things we have not seen here in Australia, as public scrutiny follows the political cycle and short memories abound.

-

The Golf Book: Green Cathedral Dreams EPUB

Original price was: $8.99.$5.99Current price is: $5.99. -

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway EPUB

Original price was: $10.99.$9.99Current price is: $9.99. -

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway PDF

Original price was: $10.99.$9.99Current price is: $9.99. -

SpeakTruth: God Knows No Words PDF

Original price was: $10.99.$8.99Current price is: $8.99. -

A Guide To Healing & Wellbeing PDF

Original price was: $10.99.$8.99Current price is: $8.99. -

SpeakTruth: God Knows No Words EPUB

Original price was: $10.99.$8.99Current price is: $8.99. -

House Therapy 2nd Edition Ebook PDF

Original price was: $8.99.$5.99Current price is: $5.99. -

A Guide to Healing & Wellbeing EPUB

Original price was: $10.99.$8.99Current price is: $8.99. -

House Therapy NEW 2nd EDITION ebook EPUB

Original price was: $8.99.$5.99Current price is: $5.99.

©Midas Word

REFERENCES

Dossor Rob, Commonwealth Debt, Budget Review 2021-22 Index, .aph.gov.au, Viewed 20th October 2022.

Grudnoff Matt, Unemployment payments and work incentives: An international comparison, The Australia Institute, February 2021, Viewed 20th October 2022.

Higginbotham Will, Blackbirding: Australia’s history of luring, tricking and kidnapping Pacific Islanders, ABC News, 17 September 2017, Viewed 20th October 2022.

Martin Peter, Why Labor’s first ‘wellbeing’ budget will have more rigour than any before it, ABC News, 20 July 2022, Viewed 20th October 2022.

Murphy Katherine, Labor to support global push for minimum 15% tax rate on multinational corporations, The Guardian, 27 April 2022, Viewed 20th October 2022.

Trimarchi Joseph, Is Australia Headed for Recession?, .linkedin.com/in/joseph-trimarchi/, Viewed 20th October 2022.

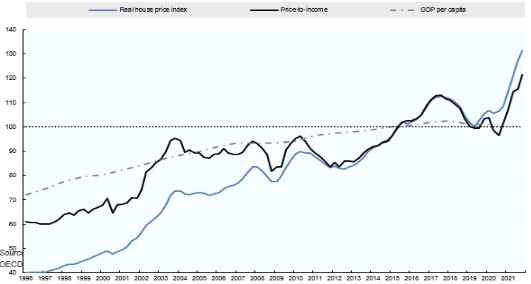

UNSW Media, New Report: Wealth Inequality in Australia and the rapid rise in house prices, 22 July 2022, Viewed 20th October 2022.

Average Rating