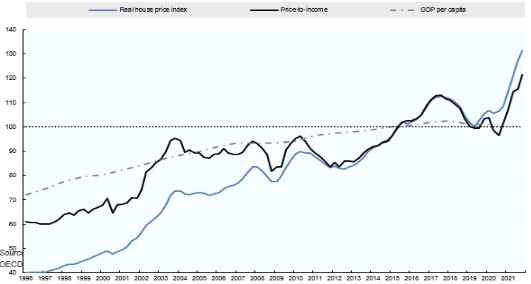

There are housing crises happening all over the world. Rents have sky rocketed and property prices are unaffordable for many citizens. Market forces are not meeting the needs of the people. Some operators within the industry are telling us that it is all about a shortage of housing stock. However, houses and property are so expensive now it is no easy thing to just build more houses. Quite simply, the current set up is not working. Providing shelter is a basic prerequisite for governments in their role of looking out for their citizens. The economic settings are making some people wealthy via property ownership and another section of the community poor because of their omission in this regard.

Figure 3.1Development of house prices, Australia, 1996–2021

Source: OECD, HM1.2 Housing prices (spreadsheet 1.2.1 AUS), https://www.oecd.org/housing/data/affordable-housing-database/housing-market.htm (accessed 3 October 2023)

“Among renters and mortgagees combined, it found 75 per cent of people are scared about their financial security because of the housing crisis.”

Market Forces Have Failed The People In Housing

Government for all of the people is another general credo that most elected governments claim adherence to. It seems that we are returning to pre-Enlightenment times when the propertied class was drastically favoured by the governments of the day. Neoliberalism has created an unfair 2 speed economy, the ‘haves’ and ‘have nots’. The gulf between these two groups is widening more and more in terms of wealth and opportunity. Housing has become the flash point for social unrest. Families living in tents on the fringes of cities is not conducive to a socially cohesive whole. Poverty invariably produces crime and divisiveness.

“Low standards and rising rents in the private rented sector are not the UK’s only housing problem. Recent rises in homelessness and rough sleeping, and the lack of affordable homes for sale and for social rent, also need addressing. “

“Just 15.5% of homes for sale were affordable for a typical U.S. household, the lowest share since Redfin started tracking this a decade ago. A home is deemed affordable if the estimated mortgage payment is no more than 30% of the average local monthly income.

Affordability plunged 40% from before the pandemic, and 21% from just last year. Redfin says spiking mortgage rates were a key reason why.”

Governments Must Step Up To Prioritize Housing Their Citizens

If governments cannot oversee economies that provide fair opportunity for all of their citizens it is a failure of government. If these governments are in thrall to the money and power of the wealthy and those with vested interests it produces the stark imbalance we are seeing now. Government agencies like the ACCC and ASIC are supposed to monitor the market to ensure a reasonably fair and competitive marketplace. Duopolies and oligopolies are failures to get the job done in this regard. We are living in a time of the greatest concentration of market power in too few hands ever seen before. Toothless tigers are rife in the halls of power, having been bought off with well paid job opportunities and other corrupt means. Politicians and public servants are in the pockets of wealthy corporations. The love of private property ownership has pervaded relentlessly through all levels of government and the greater community. Nothing really stands in its way.

Private Wealth Struggles With Social Problems

Property ownership is the main means for the creation of generational wealth for the average citizen in the 21C. This is becoming increasingly expensive to manage and many citizens are locked out of the property market due to its high costs and returns. A Frankenstein monster has been created by the banks, property sector, and complicit governments. Housing is no longer shelter first and foremost it is another financial product. The financialization of all aspects of life continues apace. The money market’s rapacious appetite for ever more profits and growth turn everything into a financial product. The Commonwealth Bank of Australia declared a $10 billion profit in the last financial year. Lending money for mortgages is the bread and butter for many banks globally.

Financialization Buggering Up Housing For Shelter Requirements

When are we going to wake up to the fact that this financialization is making the lives of many people miserable. The 2008 Global Financial Crisis was at its root a subprime mortgage loan debacle. This brought the house of cards down and cost global economies some $30 trillion. The money market driven by the pension fund managers is forever looking for higher returns. It is a desperate dance on the edge of risk and reward. Capitalism has morphed into this crazy high stakes game played with the homes and assets of real people rolled into faceless financial products for banks to deal and bet with. Profits and higher returns on investments are rolling over the lives of ordinary people like a grader flattening the landscape for future development. Nations are getting ever bigger via population growth, which means larger governments and more massive corporations. Individual lives are being lost to the proliferation of powerful entities which matter more, it seems. Housing crises are happening all over the world and market forces are definitely not the answer.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord