Australian banks do not even have enough staff employed in their scam crisis emergency departments to take your call in a timely manner. Calling the Commonwealth Bank you can be on hold waiting to talk with someone about your disappearing money until it is too late. Scamming and Australian banks: The real story. The Big 4 Banks, ANZ, CBA, NAB, and Westpac won’t take responsibility for securing your money from scammers, despite the fact that they are supposed to be banks, first and foremost. In the old days, banks locked up your money and that is why you deposited your hard earned money there in the first place. Not today, banks are all about convenience and not security. They don’t offer any interest on your savings so what is the point of them. They skim off the top of every transaction, so, when your hard earned money is scammed from you, they don’t care, as they make money on the transaction anyway.

Who Will Hold Australian Banks Accountable For Scams & Losses?

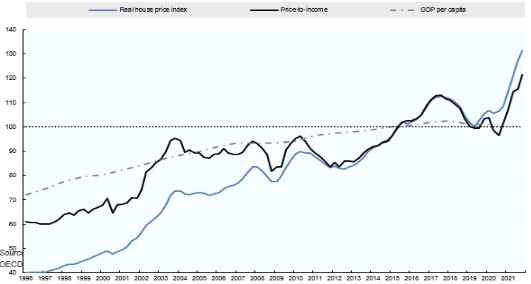

Who is going to hold our banks accountable? Will the powers that be grow some courage and take on the banks? Or are they too big for governments these days? The banks have grown fat on the back of runaway inflation in the Australian residential property market. Lending billions to property investors has reaped them mega-profits. Commonwealth Bank just declared a $10 billion profit this year. Rising interest rates increases bank revenue and profits. Houses are too expensive to buy for many. Rents across Australia have gone through the roof. The lucky country has become too pricey to live in for large sections of the population. Is that good government working for the people or just for the privileged few?

Despite the record profits Australian banks wont even spend some funds on dealing properly with the proliferation of scams impacting their banking clients – it’s a disgrace.

“Between 2019 and 2022 reported scam losses via bank transfer in Australia increased by a staggering 200%, she said. “These figures paint a disturbing picture of the outsized vulnerability of our citizens to scams and the bad news is that things are likely to get worse,” Clarke said. Last financial year the major banks reimbursed just 2% to 5% of their customers’ losses, according to a report released in April by the Australian Securities and Investments Commission.”

Aussie Banks Too Mean & Cheap To Stop Scammers

Australia’s Big 4 banks are some of the most profitable banks in the world. The fact that they control such a large concentration of the banking business in this country is another failing of the ACCC. Less competition in the banking market means they can charge what they like and set the prices. Similarly, their range of services can be limited in cartel like arrangements to benefit them rather than their customers. You have to ask yourself how hard would it be to place review procedures over large transactions, which should flag some oversight? The convenience of the digital age makes transferring money super easy and involves no banking staff. The downside of this in the age of the scammers is that clients are losing large amounts of their money.

It is remarkable that banks do not realise that a tipping point will soon be reached, as the news of the massive losses incurred to scammers damages their business permanently going forward. Why use these banks if they offer bugger all security and no fail safes from being scammed.

“Consumers are being warned to be wary of phone calls and texts that appear to be from their bank, following alarming reports of Australians losing their life savings to a highly sophisticated impersonation scam. Reports to the ACCC’s Scamwatch indicate scammers are using new technology to trick their victims, by making the call appear to come from the bank’s legitimate phone number or by sending a text that appears in the same conversation thread as genuine bank messages. Scamwatch received 14,603 reports about bank impersonation scams in 2022, resulting in more than $20 million in losses. Total losses to phone and text scams increased significantly last year, with over $169 million lost.”

Neoliberal User Pays Mentality Rife in Australian Banks & Business

If you are scammed and lose your money, despite it being deposited in an Australian banks, their attitude is – “tough luck buddy!” Aussie banks are in the rent seeking business, as they take their cut on every transaction you make and via bank fees or rents. They don’t care about much else, as service is a thing of the past in their business model these days. Convenience is king and security is way down on the list of important stuff. We will see if this holds up through the scamming crisis currently hitting Australians where it hurts.

Scammed Out Of $400, 000 From Their Bank Account

“The bank clerk and I waited on hold together for almost half an hour before I realised something. My question was faltering: “Are we calling … the same helpline number that I would call if … if I was at home?”

The sweet-faced clerk nodded.

“They don’t give you a direct number you can call, something to get you straight into the banking services division? Even though you work for the same bank?”

I shouldn’t have been surprised. I’d spent the week on air talking to John and Julie, the victims of the worst identity theft and financial fraud I’d ever been told about. Their loss of almost $400,000 – their retirement savings – the theft of their identity, the fraudulent accounts opened and then siphoned off in their names, is a contemporary horror story about the reality of privacy that now hangs by slim, digital thread. They had told me of sitting on the phone for hours to their banks’ emergency fraud lines as they watched the money draining out of their accounts in real time, with nobody picking up at the other end. Their telco didn’t operate a call centre on weekends, so their stolen mobile number was swiftly ported elsewhere, and they were powerless to stop it. The thieves, now in control of their phone, were receiving the two-factor authentication codes they had prudently enabled and were using them to transfer more and more money out.”

Wake Up Australia & Let’s Do Something About Making Banks Accountable!

It is time to demand that banks and governments are made more accountable for the digital security mess that banking and the financial services realm is in right now. Australians lost more than $3 billion to scams in 2022. It was the banks corporate decision to go digital and the balance between convenience and security has tipped way out of whack. Identity fraud is out of control in Australia and this user pays mentality means banks are taking no responsibility despite profiting from the transactions.

Read the new book Money Matters: Navigating Credit, Debt & Financial Freedom by Robert Sudha Hamilton

©MidasWord