Of course, negative gearing needs to have limits imposed upon it, as does the capital gains tax offset. It has only been political expediency, which has maintained these inequitable economic policies for so long in Australia. Yes, there will be howls of protest coming from those benefitting directly and indirectly from these policies. The real estate sector will be up in arms and crying that the sky will fall down upon us all if these changes are made. The aspirational voter (those who see property investment as their pathway to riches) will be dead set against any changes to either negative gearing or the capital gains tax offset.

Unaffordable House Prices & Negative Gearing

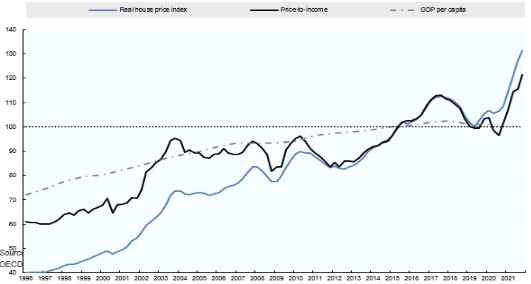

“As I will explain in more detail later, three main things pushed up demand for housing after 2000: a sharp lift in immigration that increased the number of people needing a place to live; capital gains tax breaks and negative gearing, which represent a $96 billion per year subsidy for buying houses; and federal first home buyer grants, which represent a $1.5 billion direct addition to house prices each year.”

Alan Kohler, in his recent essay on why property prices in Australia are now so unaffordable for many ordinary Australians, summed the situation up pretty well. He puts the changes to the capital gains tax by John Howard back in the 1990’s as the main economic cause for the shift in the value of the average Aussie home from 6 times annual income to around 12 times. Kohler cites the fact that his parents and he himself purchased their family homes at the lower rate and that his kids are now faced with around double that rate in the 21C.

Nothing will change in this regard unless we do something about the economic polices causing it, he concludes.

Negative Gearing & Capital Gains Tax Subsidies

Think about that figure of $96 billion going missing from the Australian tax revenue on a yearly basis. That money is going into the pockets of wealthy Australians at the expense of those that can least afford it. It is time that we honestly add up all these tax breaks and subsidies that we are providing to some of us and to big corporations. Australia has historically bent over backwards in return for international investment. This has morphed into economic policies which are exceedingly pro-investment. The fact that some sections of society and big business are taking undue advantage of these economic settings has produced a widening divide between the haves and have nots. This gulf is greater than it has ever been in our history as a nation. It is time to reassess these overly generous inducements for investment and to grow up as a country. Mature nations have a greater sense of their own worth. Our politicians have to stop being small men and women when it comes to negotiating resource extraction deals with multinationals.

Self esteem does not come naturally for nations and individuals. The daughters and sons of a once convict dumping ground and isolated land at the bottom of the world map may need to work on their sense of self worth and that of their nation.

Our Politicians Are Landlords

Money makes many folk feel more secure and amassing lots of it can provide a modicum of greater self-worth, according to some. Perhaps, this is one of the reasons why some people are motivated to keep on making more and more money. There are Australians who own hundreds of residential properties and use negative gearing as a key factor in this extreme wealth creation. Most of our politicians own multiple dwellings and earn incomes from rent as landlords. It is said that Peter Dutton is worth some $300 million from property investment and a string of child care centres. The Leader of the Opposition is dead set against any changes to negative gearing or capital gains tax. He is the champion of the aspirational vote in this country.

Private wealth vs the public good is the age old battle within most modern economies.

Private Wealth vs Public Good

The acquisition of private wealth when it comes at the expense of the public good or the common wealth produces unfair and inequitable societies. Australia has to ask itself which road it is going to go down in 2024 and beyond. The Coalition, who had 10 years in federal power, took the country further down the ‘user pays’ neoliberal economic model of governing. The Stage 3 tax cuts were part of a regressive flattening of the tax rates which reward the wealthy at the expense of the working poor. Wealth in Australia is going to the rich at a rapid rate via the concentration of market share in too few corporate hands. The ACCC and the governments behind it have failed to preserve competition and overseen multiple mergers at the expense of consumer power. Big business has had the tacit and overt support of government in its bid to form behemoths in duopolies and oligopolies. Corporations have too much money and legal fire power to be concerned with toothless tigers like ASIC and the ACCC.

Australians are too tame and apathetic to do much about what their leaders get up to in boardrooms. I cannot imagine the French in Paris putting up with what we meekly go along with.

Stage 3 Tax Cut Amendments Fairer

The Albanese federal government amended the stage 3 tax cuts to halve the largesse being afforded the wealthier and share the spoils with poorer working Australians. This managed to wedge the normally virulent Dutton and his LNP party with too many Aussies happy to get a lick of the ice cream. Now, the Greens have arced up and are calling that negative gearing needs to have limits. Perhaps, this may result in something being done about the inequitable economic policies which have seen property prices become unaffordable for many younger Australians. There is a severe rental crisis happening here, also, with a shortage of rental stocks pushing up prices. There will be a stoush over this, with the industry claiming that negative gearing is essential for investors to build more rental houses and flats. Obviously, the state governments have to pull their fingers out and build much more social housing as a matter of some urgency. Australians have a choice, which comes down to the kind of nation they want to live in. Do they want to live in a fairer and more equitable country or is squirrelling away a s***load of private wealth more important?

Will this be a dog eat dog society or can they see the value of looking out for their neighbours in a community? I suppose political leadership may be important in which way we go too.

“The Greens have demanded limits on tax discounts for property investors in exchange for their support for the government’s “help-to-buy” housing scheme, which will be debated in parliament this week.

The federal government will likely need the support of the Greens to legislate a program that will allow some first-home buyers to pay just a 2 per cent deposit for a home.

Under the scheme, the government will cover up to 40 per cent of a home’s cost and become a co-owner of the home, with homebuyers able to purchase that stake back at a later date.

But the Greens say with income limits and property price caps affecting which buyers and properties are eligible, that scheme will help only 0.2 per cent of eligible buyers each year — and would only further push up house prices.”

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord