Fast Times and Cashless Highs: Technology’s Ode To Debt

“He who is quick to borrow, is slow to pay”

- German proverb

If you are young you are likely in too much of a hurry to read this and if you are older – can you remember what it was like to be young? Fast times and cashless highs: Technology’s ode to debt makes for thrilling reading. The young are in love with technology and this is a cashless highway to debt for the unwary. I picture a raceway, like Daytona, and lots of youthful racing car drivers revving their engines in anticipation of going around the bend. Young men and women risking life and limb to achieve victory over the slow lane. If you survey the top items on Santa’s gift list this year they will likely be the latest smart phone or high tech device, as they have been for the last decade or more. Humanity is in rapture with the fruits of technology, as we have always been.

The Market’s Cut & Thrust Goes High Tech

If you look back through history you will see remnants of swords and tools in museums, which were the technological offspring of metallurgy. The evolution from bronze to iron gives rise to the names of the various ages cataloguing historical eras. Of course, swords turned into guns and we all know where that has led us. The printing press, the Gutenberg press revolutionised the world in the fifteenth century and beyond. Books and pamphlets were no longer the exclusive domain of the elites. Ideas and change manifestoes were able to reach a much wider audience affecting shifts in world orders. Now, we have social media and fake news. Currently, we are in the grip of the communication and information zeitgeists and almost every Homo sapiens carries a portable device capable of these things. Touch a screen and ‘hey presto’ instant gratification.

“Australians have made big moves away from cash over the past decade, with Reserve Bank of Australia’s 2016 consumer payments survey showing only 37 per cent of consumer payments are made in cash today compared to 69 per cent a decade ago.”

- (Mitzen, 2018)

“According to PwC research, almost half the world’s digital payments in 2017 were made in China, where apps such as Alipay and WeChat Pay let consumers pay for nearly everything with their smartphones. The adoption of QR codes and explosion of e-commerce has led to a decline in the use of cash, particularly in urban China.”

- (Hutt, 2019)

The Cashless Swipe Into A Debt Trap

“Creditors have better memories than debtors.”

- Benjamin Franklin

Economists will tell you that it is the exchange of produce and money that has enabled the growth of civilisations across the ages. Buying and selling stuff is at the heart of our global domination, according to them. Technology has been in the service of the market since the beginning of time. It is the market which has financed the research and development of technologies across the globe. The young are always the first to embrace new technologies, as they seek harbingers of their own hegemony. Our youthful citizens bear no attachment to a past they did not share. Progress will race across the surface of the earth fleet footed in search of market expediency. It is cool to carry no cash and swipe your phone’s screen, when conducting a transaction, in the twenty first century. The psychology of pixels forming numbers on a screen is very different to the sound and feel of hard currency in your pocket, however. Easy come, easy go, or is it a sense of it never being real in the first place and perhaps, never really having been in your possession? Anyway, things are moving along so rapidly there is no time to waste on philosophical reflection. Fast times and cashless highs: Technology’s ode to debt mounts up like investors in Silicon Valley.

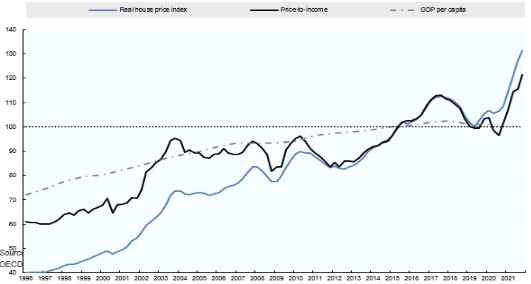

Humanity and the market are always in a hurry. There are victims, however, of the ever faster economy driven by technological innovation like cashless payment. Collateral damage, perhaps, as these young lives are corralled by debt cruelling their opportunities for a fulfilling future. Buying a home slips further out of reach of ordinary young Australians each day, it seems.

Cont. In Money Matters: Navigating Credit, Debt, & Financial Freedom by Robert Sudha Hamilton

Money Matters: Navigating Credit, Debt & Financial Freedom PDF format

Money Matters: Navigating Credit, Debt & Financial Freedom is the new book by Robert Sudha Hamilton PDF

This book is a collection of pieces written by me on specific aspects of our economy and community, especially as it pertains to credit and debt. The data and information quoted in this book is correct and true, as of the date of composition. We live in an age of credit, where our personal economies and the economies of our nations are deeply dependent upon credit. Getting to grips with the ramifications of debt and credit in the wider context of our financial sector is paramount if you want to maintain your financial freedom and lessen the pain of the ups and downs inherent within the capitalist cyclical system. Knowledge is power.

This book will help you understand stuff like the high inflation we have been experiencing. Get to grips with some economic knowledge and the social ramifications of the current financial system. Is it fair? No, it is not. Can we change that? Only by first comprehending how it works.

Money Matters: Navigating Credit, Debt & Financial Freedom.