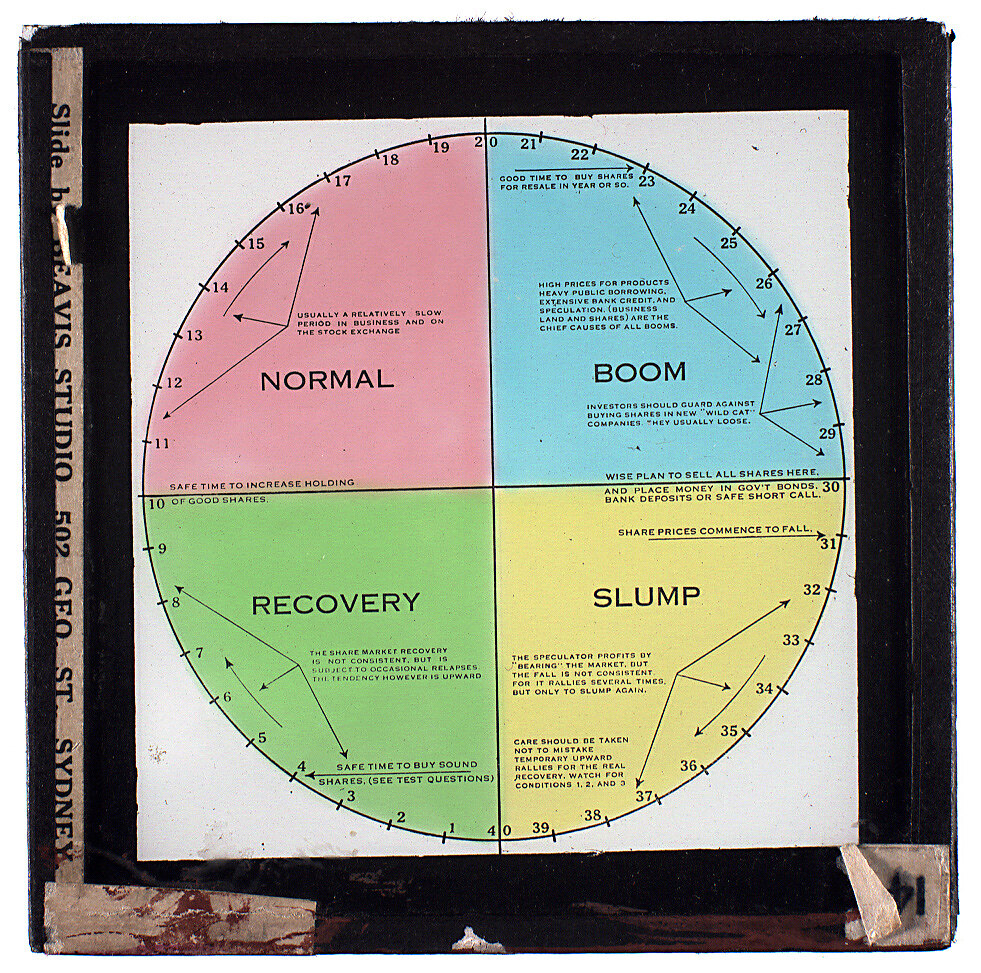

America and Australia share similar symptoms in their economies right now with high inflation sticking around. The central banks have been raising interest rates in a traditional monetary policy approach to combatting high inflation. However, it isn’t working that great. Supply side inflation not solved by raising interest rates. Both nations are suffering with housing shortages pushing up rents and this is contributing to the high inflation. Putting up interest rates is not going to help with this; indeed, it is making the situation worse. Making building houses more expensive via higher costs of doing business is not going to increase the supply of housing.

High Inflation Caused By Supply Side Pressures Not Spending

The RBA and its new Governor, Michelle Bullock, are trying to tackle supply side inflation with an old approach, which kills the golden goose to kill high inflation. Recession beckons and it is only the high level of immigration coming into the country that is staving this off. However, this is making the housing crisis even more acute, obviously, because where are all the new arrivals going to live? Ms Bullock is treading the same tired old path as previous Governor Philip Lowe. The economic pain of steeply rising interest rates hurts the working poor more than anyone else within the nation. Rents are unaffordable and the only way out is to build more housing.

Austerity Will Not Cure Supply Side Inflation Anytime Soon

Austerity is the road that the federal government and the RBA are traversing. Reining in government spending so as not to feed inflation will shrink the economy. A contracting economy means that the hard times will last longer. It also means it is less likely that the necessary housing will be built in a timely fashion. Thus, high rents are here to stay and the only movement will be upwards. High interest rates means the cost of business becomes greater and this dampens productivity. Supply side inflation is not best solved via this approach. What we need to do is spend more to increase the housing stocks.

“Fiscal policy also has to adapt: to control supply shock inflation of the type the world is now fated to experience, existing explorations of ways to steady demand over the business cycle have to embrace much bolder macroeconomic measures to control over-spending when supply plummets or becomes more volatile. “

The central banks and the government are stuck in an old way of thinking, which is not the best way of dealing with supply side inflation. Shrinking demand is not going to work with the housing crisis. Unless they think that all these people are going to be forced into mass share housing or something. Especially, as they are bringing in around a thousand new migrants per day. Right now, this government seems to be unable to grasp the enormity of the problem. Perhaps, they think it is just going to magically go away. Houses and apartments have to be built and this demands government spending. The RBA should move away from the interest rate ‘up’ button and leave well enough alone for a while. I hope that a goodly percentage of these new migrants are builders. Cause, assuming that ‘She’ll be right, is not going to cut it now.’

We need new thinking about the economy and not timid ‘do nothing’ behaviour. Neoliberalism, which has governments doing nothing, has got us into this economic mess. The market did not build any social housing and governments shirked this responsibility decades back. Wealth inequality has grown on steroids via neoliberal policies. The private sector does not care about poor people, old people, and only about ‘user pays’ people. Following the 2007 GFC wealth inequality has shifted markedly toward the rich and away from the majority of the population. Competition in the financial sector disappeared after the GFC and this spread throughout the economy more generally. Now, we have duopolies and oligopolies price setting and price gouging, which has seen prices spike and a cost of living crisis.

Corporations are declaring record profits. This is the irresponsible world we live in, where profits come before people; and governments and banks back business. We are headed for an economic disaster and a very real human crisis is already upon us.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord

-

Product on sale

Money Matters: Navigating Credit, Debt & Financial Freedom MOBI formatOriginal price was: $14.99.$11.99Current price is: $11.99.

Money Matters: Navigating Credit, Debt & Financial Freedom MOBI formatOriginal price was: $14.99.$11.99Current price is: $11.99. -

Product on sale

Money Matters: Navigating Credit, Debt & Financial Freedom PDF formatOriginal price was: $14.99.$11.99Current price is: $11.99.

Money Matters: Navigating Credit, Debt & Financial Freedom PDF formatOriginal price was: $14.99.$11.99Current price is: $11.99. -

Product on sale

How To Play Golf: Like A Winner EPUBOriginal price was: $7.99.$5.99Current price is: $5.99.

How To Play Golf: Like A Winner EPUBOriginal price was: $7.99.$5.99Current price is: $5.99. -

Product on sale

A Guide to Healing & Wellbeing EPUBOriginal price was: $10.99.$8.99Current price is: $8.99.

A Guide to Healing & Wellbeing EPUBOriginal price was: $10.99.$8.99Current price is: $8.99. -

Product on sale

SpeakTruth: God Knows No Words EPUBOriginal price was: $10.99.$8.99Current price is: $8.99.

SpeakTruth: God Knows No Words EPUBOriginal price was: $10.99.$8.99Current price is: $8.99. -

Product on sale

A Guide To Healing & Wellbeing PDFOriginal price was: $10.99.$8.99Current price is: $8.99.

A Guide To Healing & Wellbeing PDFOriginal price was: $10.99.$8.99Current price is: $8.99. -

Product on sale

SpeakTruth: God Knows No Words PDFOriginal price was: $10.99.$8.99Current price is: $8.99.

SpeakTruth: God Knows No Words PDFOriginal price was: $10.99.$8.99Current price is: $8.99. -

Product on sale

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway PDFOriginal price was: $10.99.$9.99Current price is: $9.99.

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway PDFOriginal price was: $10.99.$9.99Current price is: $9.99. -

Product on sale

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway EPUBOriginal price was: $10.99.$9.99Current price is: $9.99.

The Stoic Golfer: Finding Inner Peace & Focus on the Fairway EPUBOriginal price was: $10.99.$9.99Current price is: $9.99.