Money is a bit like religion. In that, money has been around so long, we’ve forgotten what it is. The origins of money WTF? Every new generation of us gets taught what money is and how it works. Similarly to established religious beliefs an orthodoxy teaches an approved curriculum. What if that syllabus contains mistruths and is factually wrong? Wouldn’t that result in millions of us getting the wrong idea about important stuff like money and how the financial system works? Well, the simple answer is yes.

Money Definition Subject To Debate

What we see today, unsurprisingly, is a polarisation emerging between economists in regard to the origins of money and how our national economies function. This divide has been widening like a fault line cracked open across the globe. Of course, it has its roots in political and ideological ways of seeing the world. On one side, you have a bunch of people who want the world to be all about private individuals going about their business largely unhampered by states and governments. On the other side of the debate, you have a view of the nation state sitting at the heart of the economy. I will let you guess which political parties align with which narratives.

The Money Myth

I am an ancient historian, well, I was trained in this academic study at any rate. What does this have to do with the origin of money and economics? Well, if you stay tuned I will explain. Returning to that nascent experience many of us have had in the classroom at school, where the teacher is telling us about the origin of money, here is a quick precis. Most of us were taught that money developed out of a barter system. That due to the inconvenience of trying to barter crops for sheep, or craft goods for milk, a system of shekels or pounds emerged to satisfy the desire for a smooth running economy. The orthodox teaching goes that this led to a financial system utilising a currency – which although much more complex these days is the genesis for where we find ourselves in the current era.

Historians will tell you that there is no real evidence for this. It is all based on assumptions and speculation.

History Is Used For Power In The Now

The important point to establishing origin stories in any society is what the broad brushstroke messaging can convey to the populace. This barter story, some call it the Robinson Crusoe myth, places the creative power in the hands of individuals doing business with each other. It says that money was invented by the people for the people, which is a good populist story to tell. This narrative fits with those spinning a tale about the power of the market and its central importance to the economy. The role of the state is barely mentioned in this way of explaining the origin of money. Primary school kids are taught this model from an early age. Governments and their role in the economy will not be taught until much later in the curriculum. The archaeological evidence around money tells a different story.

The History Of Money

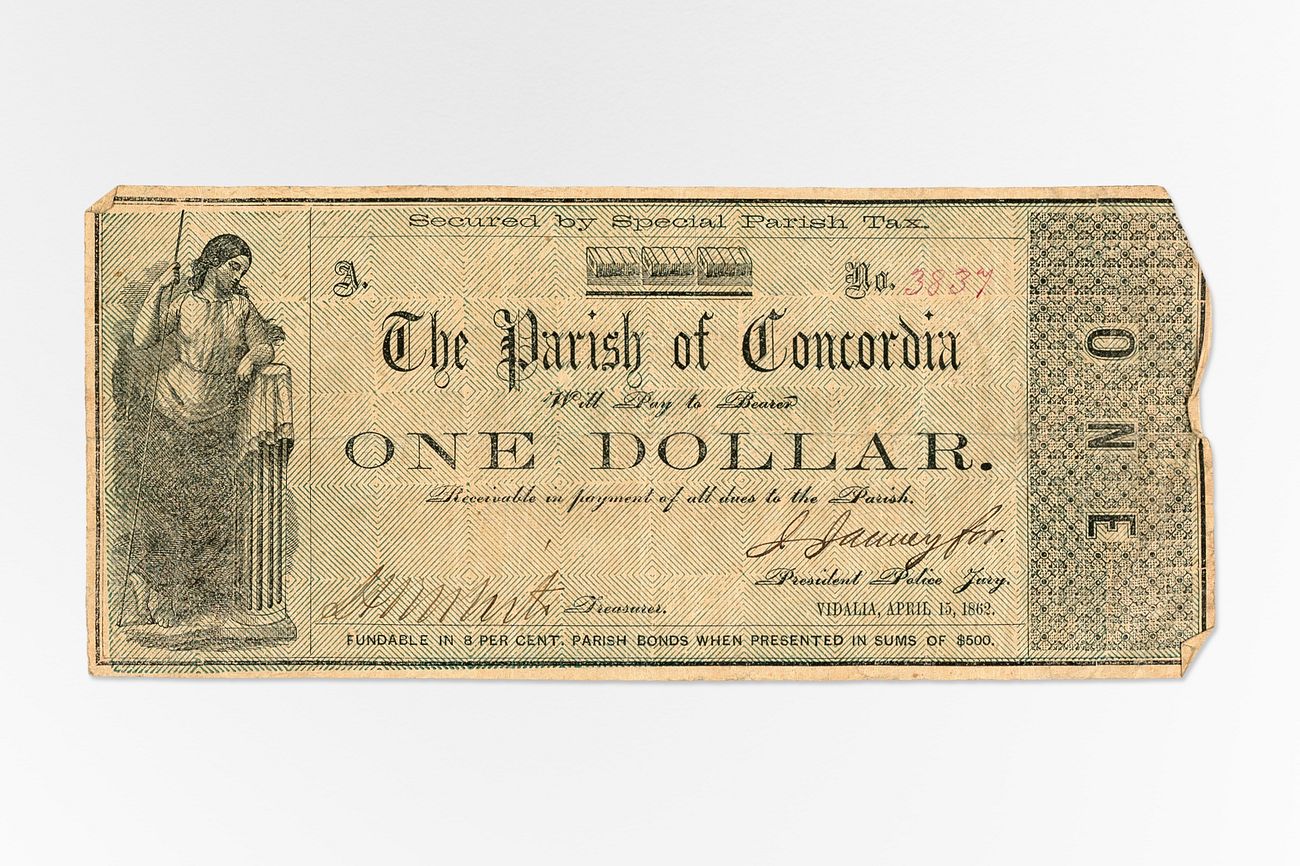

Historians know well that the value of coins bear many intrinsic purposes for the state. Ancient kings and queens had their own likenesses stamped on coins to officially remind their subjects about who was boss. What is money? Money is an IOU from the state to the holder of that currency. Money is debt. Not just any debt but state based debt. Money and taxes are inextricably linked in understanding the role of money. Rulers raised taxes from their subjects to run the kingdom. Taxes paid for the armies and wars waged by kings in the defence of the realm and in its territorially expansive role. The state issues money to its subjects as IOUs and when the taxes are paid the money or tally sticks are destroyed. Why has the fundamental role of the government in and around money been down played in the teaching of economics to our young? The state issues money through the central bank and it controls money on this basis. Of course, today there are lots more layers to consider within modern national economies but the origin of money is with the state and not with private citizens.

Your Money Is The State’s

We have to ask ourselves why this untrue version of money’s origin is taught to our young and why. What does it lead to? Why do certain groups of people want to promulgate this false view of what money is and where it came from? Is it because they want to diminish the role that governments and the state play in our lives and the economy? Separating money from taxes seems to be their key objective in this obfuscation. The historical view contradicts this and inclines to a view that money is in fact a tax credit issued by the state in acknowledgement of a debt relationship. The love of money, therefore, which is actively encouraged by those in the Robinson Crusoe camp would suffer under any acknowledgement of the state’s key role in the creation of money.

Tax A Dirty Word

We live in an age now where many people are dismissive of taxation and the role taxes have within our societies. These folk have been encouraged to see great wastage in how taxes are used by governments and to belittle them on this basis. In contrast to these people there are still those who understand the important role that taxes have within our economy and government spending on health, education, and infrastructure. Of course, inefficiencies and corruption do exist within governments and our economic systems but nothing is perfect.

Separating the concepts of money and taxation in the mind’s of the populace creates a divide where there really shouldn’t be one.

“Prostitution may be the oldest profession, but tax collection was surely not far behind. The Bible records that Jesus offered his views on a tax matter, and converted a prominent taxman. In its early days taxation did not always involve handing over money. The ancient Chinese paid with pressed tea, and Jivaro tribesmen in the Amazon region stumped up shrunken heads. As the price of their citizenship, ancient Greeks and Romans could be called on to serve as soldiers, and had to supply their own weapons—a practice that was still going strong in feudal Europe.”

- (The Economist, 2000)

“Taxation has always been a central issue in political economy because it is one of the main activities of all states and a necessary condition for everything else states do.”

Money Is An IOU From The Government To You

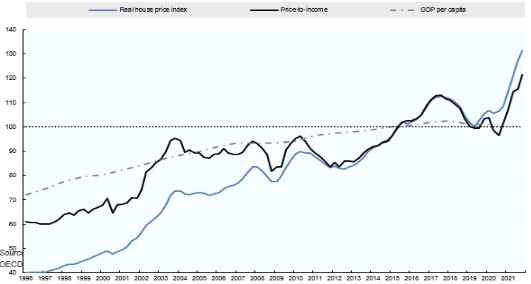

If our children were taught that money is something issued by the state as an IOU to individuals and was originally done so to recognise the payment of taxes, perhaps, this unhealthy love of money may not continue. People kill for money and do many bad things in pursuit of it. Personal wealth is the goal of many people around the world. Re-establishing money’s relationship to taxation by the state might just put a new slant on things. Political parties that promote the idea of small government, free markets, and minimal taxation are promulgating falsehoods. These populist ideas do not exist in reality anywhere. Markets are manipulated by ever larger corporations operating in duopolies and oligopolies – price setting and controlling the market. Governments in autocratic regimes spend ever more on security forces and the miliary to prop up themselves. Government spending on social programs for the poor are slashed. Taxation on the wealthy insider class is greatly reduced. The divide between rich and poor becomes ever wider. These things are happening in many places around the globe right now.

Understanding the origins of money might begin to change things over time. Whether we have time is another question to be answered. The love of money is a misguided delusion. Money is not what you think it is. We all could do with a new understanding of money and its role in the economy.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©MidasWord