Coles has some 8, 000 suppliers providing the supermarket lines they sell to their customers. Woolworths is in a similar situation re-numbers of suppliers. Supermarkets making super profits in Australia are hitting the news for all the wrong reasons. The nation is in the midst of a 2 year cost of living crisis with high inflation having stripped the savings from the working poor. A Four Corner’s expose shown on the ABC has shone a stark light on the state of play in our supermarket sector. Coles and Woolworths have some 65% of the grocery market share – this is a powerful duopoly, which puts all the advantages in their corner. Farmers supplying the duopoly are being squeezed into submission economically, as are many other suppliers of their grocery lines.

“Leaked emails show Coles has been profiting from higher prices at the check-out, despite repeated assurances from the supermarket giant that it is doing everything in its power to keep grocery bills down.

The emails reveal for the first time the tactics Coles has employed with a supplier seeking a price increase and how it has taken advantage of inflation.

It’s not alone. An industry insider has told Four Corners that Woolworths has used similar tactics to increase its profits over the last 18 months.

Australia has a highly concentrated supermarket sector where Coles and Woolworths control 65 per cent of the grocery market.”

Oz Supermarket Duopoly Doing The Dirty On Struggling Consumers

In Australia, everyone has been putting up their prices during this high inflationary period. This has resulted in the weekly shopping cart at Woolies or Coles becoming a very expensive thing for the essentials like food and household grocery items. Most of those 8, 000 suppliers have wacked up their prices and many have reduced what they put in their unit packaging. Coles and Woolworths have passed those increases onto their customers and managed to increase their profitability at the same time. Woolworths made more than a billion dollars profit most recently.

Unhappy shoppers struggling to afford to put food on the table have become far more populous downunder.

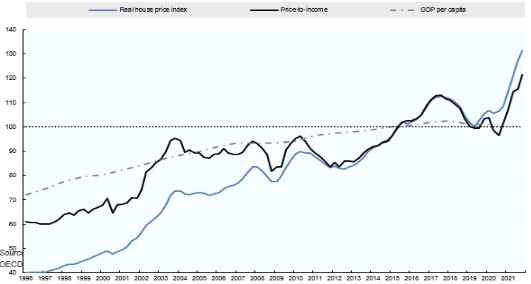

Australia A Cash Cow For Corporate Concentration in Every Sector

During this period rents and mortgages have also shot up due to a housing rental stock crisis and the RBA rapidly increasing interest rates on home loans via the cash rate. Energy prices have at the same time been at record levels. We have all been copping it in the wallet left, right and centre. Corporate Australia has been declaring record profits in the banking sector, the airlines, supermarkets, gas and oil companies, and the insurers most recently. You have to put the question – is it reasonable for these companies and businesses to raise their prices and rake in the revenue during a cost of living crisis?

Allan Fels and Rod Sims, both former heads of the ACCC have identified price gouging by many of these companies beyond their increased costs of production due to the inflationary period.

10 Years Of Coalition Governments Delivers Duopolies & Zero Consumer Power

It seems that after a decade of Coalition government, where the big end of town were feted by the LNP and little to no oversight was effected upon their activities – Australians have become accustomed to taking it up the ‘you know where’. The ACCC has been overwhelmingly ineffective in preventing mergers and takeovers. The ANZ has just won its appeal in the courts to take over Suncorp. Corporate concentration of market share in too few hands is the worst it has ever been seen in most sectors in Australia. Oligopolies and duopolies are everywhere you look. Consumers have no buying power because competition does not exist. Big business has had its way with Australians and the glad handling politicians have done sweet bugger all. Banking – the big four rule the roost. Media – Murdoch, Nine Fairfax, and Seven West control all platforms of print, TV, and radio networks. Supermarkets – Coles & Woolies have 65% of the market and they control the lucrative liquor market as well. Real Estate – just a couple of big players. Petrol stations a similar situation. The gas companies – just 4 players. Electricity – AGL, Origin Energy, and a couple of other providers. Insurance – the same old story.

What it means is that these big corporations can set the prices and consumers have little to no say in the prices they pay.

Australia, Stupid Is As Stupid Does

You could say Australians are too dumb and didn’t pay attention to what has been happening over the years. Yes, this is true, but our political leaders have let us down big time too. Both parties have sucked up to the big fossil fuel players, the miners, the big end of town, and taken their money. They have underfunded the ACCC and put out toothless tigers in the oversight roles. The Coalition has been big on industry codes with no penalties, which has produced the economic landscape we currently see before us. Bugger all competition in any direction you look. This is what they call a rentier economy, where endless fees, fines, and charges are allocated to the user pays model. Big tech is the perfect example with Google, Apple, Facebook, Amazon and Microsoft applying fees upon every service or piece of software we use. These corporations are the wealthiest in the world thanks to this model. Meanwhile, wage growth has not kept pace with the cost of living over the last decade. The Coalition had a wage growth reduction commitment underpinning their economic policies during their decade in power. Union busting has been the name of the game for several decades for the LNP. Australians woke up recently and wondered why their wages have not kept pace with the cost of living. Workers have been hung out to dry so that shareholders can enjoy ever increasing returns on their investments. The balance of power in Australia has long been in favour of the wealthy and those who aspire to that status. Aspirational politics delivered electoral success to the LNP for long periods during the last few decades. The workers forgot whose side they were supposed to be on and who historically had delivered them wage rises and better working conditions.

There are some 6 supermarket enquiries underway or about to start. This will be the government wishing to appear to be doing something about a problem they have no intention of actually doing something about. Reviews, reviews, and more reviews. Lack of competition produces serious imbalances of power. The 8, 000 suppliers have to sell to just 2 giant supermarket chains. Where do you think the power resides in that relationship? Coles and Woolies have 65% of the grocery market – their supermarkets are conveniently located where most people live and shop. There are very few alternatives and they are not usually just around the corner. The power in this set up is with the duopoly and thus they can set the prices without fear of any real competition.

To put things in perspective Coles and Woolworths have been providing world class supermarkets for many years in Australia. If the perfect storm of a cost of living crisis had not emerged we would not be seeing all these enquiries and calls for Royal Commissions into the supermarket sector. What the crisis has revealed is that the neoliberal idea that the market will take care of everything is bunkum. This non-interventionist corporatist line is blatantly untrue, especially during times of economic crises. The market is constantly being manipulated by corporations positioning themselves to reduce competition and to take more market share. Woolworths and Coles have done this successfully over decades and this is where we find ourselves. They employ some 300, 000 Australians in their operations, which makes them leading employers in terms of numbers.

Australia subscribes to the idea of a free market economy. This means that businesses are free to price their goods and services at whatever level they see fit. This is encouraged on the basis that the market via competitive forces from other businesses, will determine what price consumers will be prepared to pay. However, what happens if one or two businesses go around gobbling up their competitors by merger or takeover? Now, in this instance the free market no longer functions as freely as imagined by economists. Consumers, especially for essentials like food, are then forced to pay the prices set by the remaining much bigger businesses operating in the market. This commitment to the idea of a free market economy underpins our political and financial institutions. The RBA, our central bank, would never recommend price controls because of this ideological commitment to the free market economy. Similarly our governments walk and talk a similar line. The realisation that the free market economy is not actually functioning as it should seems not to have sunk in at the highest level in Australia. Asleep at the wheel? A realm rich in too many assumptions? Yes, it very much looks that way. Australia is not alone in this overconcentration of market share in too few corporate hands – it has happened everywhere in America, Europe, and the UK. Multinational companies are doing this everywhere and have no respect for international borders. Therefore, as a middling economic power we tend to follow sheepishly the moves of our larger brethren in the western nation stakes.

This results in the exclusive wielding of monetary policy to combat periods of high inflation in the economy. Raising interest rates on the cash rate by the RBA to suppress domestic economic activity via increasing the cost of doing business by borrowing funds. In Australia, this means home loan repayments go sharply upwards and this gets passed on throughout the economy. Rents go up and these were already trending up due to a shortage of housing stock. Once again, the market did not take care of business for the third of our working population who are renters. No social housing has been built for the past 20 years by state governments in any meaningful amount because, apparently, they were assured that market forces would take care of it. This is another failure of governments and our political leaders in Australia. The RBA with its big stick approach wanted unemployment to rise in Australia, this will put more downward pressure on wages. Their model sees wage rises as the devil in the equation. It strikes me as crazy that if rising prices have caused the high inflation in the first place and we know that the free market economy is not functioning because of the lack of competition in markets that the RBA goes around beating up those who can least afford it – poor workers, renters and the like. Wouldn’t it be more sensible to have a good look at market sectors and see if competition is working as it should and if not to look at price controls where appropriate.

You cannot have ideological mist blinding us from seeing what is really going on in the economy.

Supermarkets making super profits in Australia are but one key illustration of a free market economy not functioning fairly or effectively. Corporate Australia has been too successful in removing competitive constraints from their economic growth. Markets have been divested of consumer power at the expense of everyday Australians. The wealth of the nation is unequally being siphoned off into the bank accounts of companies, trusts, and individual tax shelters. Governments and their monitoring agencies have been bought off by campaign donations and promises of lucrative jobs post political and public service careers. I do not see any other way out of this apart from breaking up duopolies and oligopolies with too much market share. Yes, you can be too successful in business and this destroys the game for the other players. Will the Australian people wake up and rise up and say enough is enough?

Robert Sudha Hamilton

©MidasWord